Introduction

The Customer Lifetime Value (CLV) is the net profit generated from a customer’s entire future relationship. Customer lifetime is calculated by multiplying average spend by average customer lifespan.¬

For businesses, it’s important to understand because it helps them figure out how to acquire and keep customers. In addition to measuring CLV, you can use it to measure the effectiveness of your marketing campaigns. In addition, businesses can use it to identify their most profitable customers.

What is CLV?

Customer Lifetime Value (CLV) measures the revenue a business can expect from a customer over their lifetime. You can see how much a customer is worth beyond one transaction using CLV in eCommerce.

CLV matters in ecommerce

Understanding Customer Lifetime Value (CLV)

In eCommerce, CLV means focusing on long-term customer relationships instead of short-term sales. CLV gives you a better sense of sustainable growth and recurring revenue, which is vital to scaling. It also allows you to better optimize your marketing campaigns and allocate resources more efficiently. Additionally, CLV can help you identify customer segments to target and tailor your product offerings accordingly.

Benefits of CLV

Increasing customer retention: CLV shows that retaining customers is often cheaper than acquiring new ones.

Resources can be better allocated: You can spend more on high-value customers.

CLV boosts profit margins by focusing on customers who buy from you again and again.

Why CLV Matters For Ecommerce Businesses

Understanding Customer Lifetime Value (CLV)

Revenue Growth

High CLV customers are consistent revenue. By identifying and nurturing these customers eCommerce brands can stabilize cash flows, reduce dependence on new acquisitions and increase revenue predictability.

Retention vs Acquisition

Understanding Customer Lifetime Value (CLV)

Acquiring new customers can be expensive, often requiring discounts or incentives. Retaining high CLV customers is cheaper and generates more returns. Retention strategies increase profitability and encourages word of mouth.

Competitive Advantage

By focusing on CLV you gain a competitive edge. Loyal customers buy more often, refer others and become brand advocates that boost your brand reputation.

Calculating Customer Lifetime Value in eCommerce

Understanding Customer Lifetime Value (CLV)

Metrics and formulas

Here’s how you calculate CLV:

The average order value is the total revenue divided by the number of orders.

The average number of orders a customer makes in a given period.

A customer’s life expectancy is how long they’ll stay with you (usually in years).

What’s CLV?

CLV = Average Order Value x Order Frequency x Customer Lifespan

Calculate your CLV

The historical CLV is based on actual customer orders. It’s accurate, but it doesn’t take future potential into account.

Modeling and analytics are used to predict a customer’s future value, so we can forecast revenue from new customers.

Software and Tools for CLV

Google Analytics, CRM systems (like Salesforce), and specialized tools like Kissmetrics provide the data and visualisation needed to calculate CLV. Tools like these allow you to automate data collection and model CLV based on historical and predictive data.

How Clv Affects Ecommerce

Satisfaction with the customer experience

Understanding Customer Lifetime Value (CLV)

Customers are happier and more loyal when they get a good experience, so CLV goes up. It’s important to have an easy to use website, a simple checkout, and fast customer service.

Product or Service

A good product or service that meets customer expectations leads to repeat business. Customer churn and customer lifetime value are negatively affected by bad products and services.

Personalized and engaging

CLV increases when you personalize with targeted recommendations, tailored discounts and email engagement. Using these strategies makes customers feel valued and more likely to come back.

Efforts to retain customers

Customer support, whether it’s live chat, email, or phone, can make a one-time buyer a repeat buyer. The better the support, the higher the customer satisfaction and the higher the CLV. This,¬

Understanding Customer Lifetime Value (CLV)

in turn, leads to more referrals, more purchases, and more customers. Good customer service should be a priority for any business that wants to grow and succeed.

Customer Lifetime Value: How to Maximize It

Getting to know our customers

Understanding Customer Lifetime Value (CLV)

Websites that are easy to use.Simple, easy-to-use websites keep customers engaged and reduce bounce rates. A simple navigation system, clear product descriptions, and mobile-responsive design make shopping easy.

Checkout is easy.To increase repeat purchases and decrease cart abandonment, reduce checkout friction by offering multiple payment options.

Delivered fast and reliably.The faster you ship, the more trust you build. Having reliable delivery options encourages repeat purchases and increases customer loyalty.

Personalization and targeting

Recommendations powered by data.A personalized recommendation based on your browsing and purchase history increases CLV. Increase sales and engagement with email or in-app product suggestions based on past purchases.

Understanding Customer Lifetime Value (CLV)

Discounts and offers.You can build brand loyalty by giving repeat customers early access to sales and loyalty discounts. To get repeat business, offer tailored incentives to high CLV customers.

Retention and loyalty programs

Loyalty Program Types.Make rewards based on points, subscription discounts or tiered programs. The rewards make loyal customers come back and increase their lifetime value.

Understanding Customer Lifetime Value (CLV)

Here are some examples of loyalty programs.There are loyalty programs at Sephora and Amazon Prime that make it easy to spend consistently. With Sephora’s rewards program, members get free shipping and access to free content, while Amazon Prime drives CLV by offering free shipping.

Getting feedback from customers

Understanding Customer Lifetime Value (CLV)

The feedback loop.Understanding customers’ needs is easier with surveys, reviews, and post-purchase feedback. Customer feedback shows a brand values its customers, which builds loyalty and engagement.

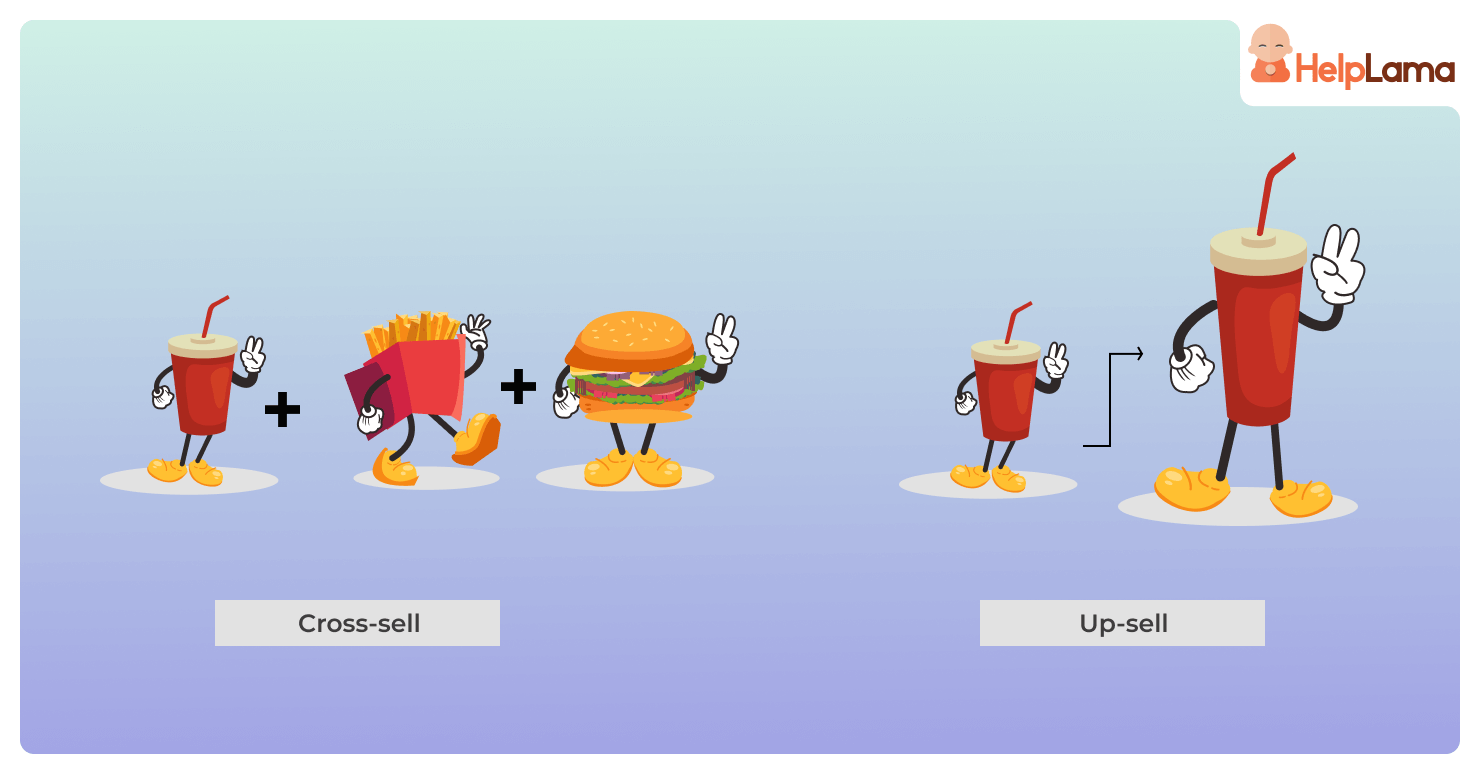

Upselling and Cross Selling

Understanding Customer Lifetime Value (CLV)

Offer customers premium versions of products (upsell) or complementary items (cross-sell) to increase order value. An Amazon recommendation engine increases average order value by suggesting products at checkout.

Engaged subscription models

Subscriptions can increase CLV by getting customers to buy monthly or yearly. For consumables or services where customers benefit from regular shipments, this model works well.¬

Understanding Customer Lifetime Value (CLV)

This model also helps to create a steady stream of income for companies. Additionally, subscription models can help to build relationships and loyalty with customers.

Monitoring CLV over time

KPIs for customer lifetime value

Understanding Customer Lifetime Value (CLV)

Focus on these things when measuring CLV:

A repeat purchase rate is how many people buy again.

The average order value (AOV) is how much you spend on each order.

The number of transactions per customer.

Analyzing CLV in real-time

CLV can be tracked in real-time with Google Analytics, Shopify and HubSpot. Monitoring high value customers regularly helps businesses identify patterns and adjust to increase profitability.

With CLV data, you can keep improving

It’s important for businesses to track CLV data regularly to make sure they’re giving customers what they want. Businesses can ensure that their customers are more satisfied and loyal by adjusting marketing strategies based on CLV insights.

CLV Optimization Challenges

Protecting your data

Understanding Customer Lifetime Value (CLV)

Keeping data collection and privacy laws (like GDPR) in balance is key. Data is important for personalisation, but businesses have to handle it responsibly.

The complexity of attribution

The exact impact of marketing on CLV is hard to figure out. Attributing revenue to specific CLV efforts is complicated with multi-touch attribution models. However, it is clear that marketing plays an important role in driving customer loyalty and retention. Understanding the impact of marketing on CLV can help companies measure the success of their efforts and optimize their marketing strategies.

Changing customer behavior

As customer behavior and market trends change, CLV strategies need to change too. To optimize CLV over time, you need to be agile and adapt to changing customer behavior.¬

Understanding Customer Lifetime Value (CLV)

Regular customer surveys and data analysis can help you identify new opportunities and adjust your strategies accordingly. You also need to be able to quickly adjust your pricing, product features and customer services to stay competitive.

Testimonials and examples

Examples from real life

Understanding Customer Lifetime Value (CLV)

The Amazon Prime program encourages frequent use by offering free shipping, exclusive deals, and content.

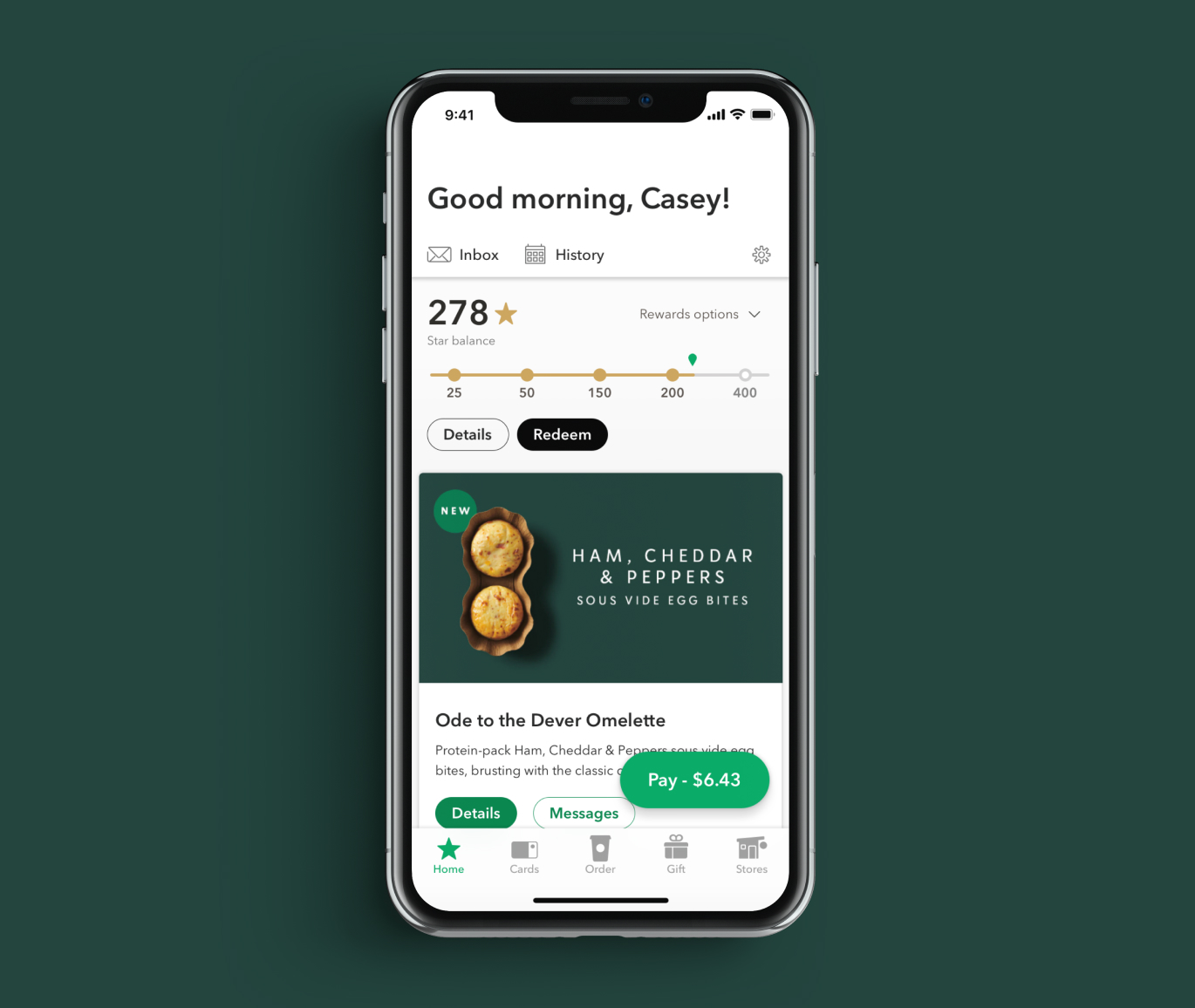

Boost CLV with Starbucks Rewards, a loyalty program that rewards repeat purchases with points that can be redeemed for free stuff.

Example Takeaways

Encourage frequent interaction: Programs like Amazon Prime encourage frequent interaction.

Offer Tangible Benefits: Rewarding loyal customers with exclusives or benefits encourages them to keep coming back.

Make Sure You’re Consistent: Consistent quality and service builds trust, which leads to customer loyalty.

Conclusion¬

CLV is not just a metric; it‚Äôs a growth focus for eCommerce. By understanding CLV businesses can optimise customer experience, drive loyalty and increase profitability over time. CLV helps businesses identify high value customers and allocate resources accordingly.¬

It can also be used to predict the lifetime value of a customer, as well as measure the success of marketing campaigns. CLV can also be used to inform pricing decisions, as well as help businesses identify potential areas for expansion.¬

CLV can also be used to evaluate the effectiveness of customer retention strategies, as well as help businesses understand customer churn and attrition.